Have questions?

Call or text Mike Artman at (949) 736-1596

One Simple Application,

and No Financial Statements

up to $500k!

✅ Terms from 12 - 84 Months

✅ 90 Day Deferred Payments

✅ Working Capital

✅ Zero Down at Signing

✅ Rates as low as 6.99%

✅ E-Docs

✅ 100% Pre-funding

✅ Private Party Transactions (OK)

✅ 93.6% approval ratio

✅ Equipment Lines of Credit

Outstanding Customer Service

Helping businesses thrive since 1997!

“iFinancial Group was great to work with for our equipment financing needs. There weren’t any surprises and the whole process was seamless. We will definitely be contacting iFinancial Group again."

Ryan Winter

Drift Distillery

"Fifteen years ago, we used iFinancial Group and haven’t changed our course since. Every time we have an opportunity to acquire equipment, we call iFinancial. They are very fast in getting approvals which makes the process better for us and our supplier."

Chuck Benson

South Coast Circuits

"I have worked with iFinancial Group on several projects over the past ten years. They have always handled my account with a highly proficient and positive approach to my financial needs."

Steve E. Castillo

MPC Design Technologies, Inc.

Frequently Asked Questions

1. How long does it take to get approved?

Most approvals are completed within a few hours , with final decisions typically made within 24 hours after submitting your application.

2. How soon will my loan be funded?

We offer same-day funding for most applicants once all necessary documents are submitted and approved. In some cases, funding may take 1-2 business days depending on the program and transaction details.

3. What are the credit requirements?

We work with companies that have a minimum of two years in business. Also, business owners typically need credit scores of 675 or better. If you're unsure about your eligibility, apply for a soft credit pull (won’t affect your score) to see your options.

4. What types of equipment can I finance?

We finance all essential business equipment, including new and used machinery, vehicles, construction equipment, medical devices, and more. No age restrictions on used equipment!

5. What are the financing terms?

We offer flexible financing terms from 12 to 84 months, with options for 90-day deferred payments and zero down at signing.

6. Do you offer working capital loans?

Yes! In addition to equipment financing, we offer working capital loans

and equipment lines of credit to help businesses maintain cash flow.

7. Can I buy equipment from a private seller?

Yes! We support private party transactions, meaning you can purchase equipment

from individuals and other businesses not just dealerships.

8. What are the interest rates?

Our rates start as low as 6.99%, depending on your credit score, length of time in business and the type of equipment being financed.

9. Will applying affect my credit score?

No, we use soft credit pulls for initial applications, so your credit score won’t be affected when checking your eligibility.

10. Do I need collateral to qualify?

No additional collateral is required— the equipment itself serves as collateral for the loan.

11. What if I don’t have a perfect credit score?

We understand that business owners may have less-than-perfect credit. If your score is below 675, we may still have financing options available, especially if your business has strong financials.

12. How much can I finance?

We offer application-only financing up to $500K. For larger amounts, additional

financial information may be required.

13. What documents do I need to apply?

For most transactions, all you need is:

- A completed one-page application (takes 5 minutes!)

- Driver’s license

- Business bank statements (last 3 months) (for larger loan amounts)

14. Do you work with startups?

Our standard financing requires at least 2 years in business, but we do offer some options for newer businesses —reach out to discuss your situation.

15. How do I apply?

It’s easy! Start by using the Apply for Equipment Funding form at the top of this page and complete the short application form in just 2 minutes. Once submitted, you will be pre-qualified and provided a link to the short one page loan application.

Have Questions? Let's Talk.

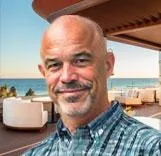

Mike Artman

Senior Loan Manager

iFinancial Group

Text or Call (949) 736-1596

324 Avenida de la Estrella

San Clemente, CA 92672

iFinancial Group is a financial services provider offering equipment financing and business funding solutions. All financing is subject to credit approval and underwriting standards. Terms, conditions, and rates may vary based on applicant creditworthiness, business financials, equipment type, and other underwriting factors.Rates as low as 6.99% are based on qualified applicants and may not be available for all borrowers. Financing is available for businesses with at least two (2) years in operation and a minimum credit score of 675. Application-only approvals are available up to $500,000; amounts above this threshold may require additional documentation.iFinancial Group is not a direct lender but facilitates financing through a network of trusted lending partners. Loan funding times are estimates and are not guaranteed. Same-day funding is available for qualified applicants who submit all required documentation in a timely manner.Soft credit pulls are used for initial pre-qualification and will not impact credit scores. Hard credit inquiries may be required for final approval and funding. Equipment financing transactions may be subject to lender fees, documentation fees, and other applicable costs. Please review all terms and conditions before finalizing any financing agreement.Private party transactions, used equipment financing, and working capital loans are subject to additional requirements. Not all applicants will qualify. iFinancial Group reserves the right to modify, suspend, or discontinue any financing program at its sole discretion.For questions regarding financing terms, eligibility, or documentation requirements, please contact iFinancial Group at [email protected]